Background

At inception, the swap fee for the ROBOT/WETH Balancer pool was set at 4.2%, more than 10x the default fee for Balancer Smart Pools (0.3%). This oversized fee was primarily used as a mechanism to reduce the impact of impermanent loss on early liquidity providers.

This protection would usually be provided in the form of liquidity incentives, however the MetaFactory DAO decided that the higher swap fee was a more suitable incentive for LPs who provided liquidity as ROBOT grew from <$1m to ~$8m market cap, and for the DAO (not needing to outlay tokens for LP rewards).

Abstract

Now that the ROBOT market cap is higher, and there is a more diverse set of liquidity providers including the DAO itself (~20% of total liquidity), we believe that it will be beneficial to reduce the swap fee to between 0.25% and 1%, to sit in line with comparable pools across the ecosystem.

The smart pool owner is currently the MetaFactory DAO multisig, so from a technical perspective we would need to initiate a transaction from the multisig to adjust the smart pool parameters.

Motivation

ROBOT/WETH liquidity currently sits at ~2m, a very respectable number considering the market cap of the token and limited number of holders (~700). During discussion around a potential liquidity strategy, we realized that liquidity isn’t lacking, however volume (currently $5k-$20k daily) is.

The ancitipated result of this proposal is that a lower swap fee will reduce friction for users trying to buy and sell ROBOT, as well as potentially attracting users from a broader base who may look to trade the pair actively and take advantage of volatility/arb opportunities.

There are also several paths to be explored around external liquidity incentives, via Balancer LM program, SushiSwap Onsen LM, or another platform all together. The first step in order for ROBOT to be considered for either of these however, is to increase the daily swap volume (~$300k daily for Onsen, unspecified for Balancer).

Specification

We propose that two Snapshot votes are initiated:

- Should the MetaFactory DAO reduce the swap fee from 4.2% to a level between 0.25% and 1%? (to be specified by second vote if successful)

- Yes - reduce swap fee

- No - do not reduce fee

In the event that this first vote passes, a second vote would be initiated:

- Where should the updated swap fee sit?

- Reduce fee to 0.25%

- Reduce fee to 0.42%

- Reduce fee to 0.69%

- Reduce fee to 1%

- Change fee to dynamic (Between 0.1% and 1%)

We’ll first gather sentiment via the polls at the bottom of this post, before moving to a snapshot vote.

If both proposals pass, the MetaFactory DAO multisig keyholders would be instructed to make the necessary adjustment to the Smart Pool parameters.

Benefits

Benefits of reducing the swap fee include:

- Reduced friction for new users who want to buy ROBOT and join the MetaFactory community.

- Possibility of increasing swap volume to a point where ROBOT could be included in an external liquidity incentive program, which would in turn increase demand for ROBOT and the pool.

Drawbacks

Drawbacks of reducing the swap fee include:

- Possibility of liquidity decreasing overall as there is less incentive for LPs to continue to provide liquidity at lower fee return rates.

- MetaFactory DAO earns less on it’s liquidity position due to reduced fee rates.

Conclusion

We see this proposal as a net positive for the MetaFactory DAO, community and the ROBOT token. Reducing the swap fee means that we can build exposure of ROBOT and therefore MetaFactory to a wider audience through increased token accessibility and the potential for external liquidity incentives.

Vote

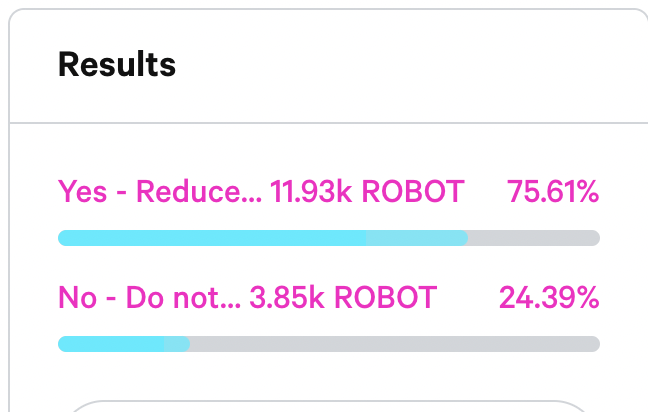

Should we reduce the swap fee?

- Yes - Reduce Swap Fee

- No - Do not reduce swap fee

0 voters

If yes, what should we reduce the fee to?

- Reduce fee to 0.25%

- Reduce fee to 0.42%

- Reduce fee to 0.69%

- Reduce fee to 1%

- Change fee to dynamic

0 voters

)

)